Free invoice software? Yeah, it sounds too good to be true, right? But tons of options are out there, promising to simplify your invoicing without breaking the bank. This guide dives deep into the world of free invoice generators, exploring their features, limitations, and everything in between. We’ll cover everything from legal implications and security concerns to user experience and integration with other business tools.

Get ready to level up your invoicing game!

From comparing different platforms and their features to understanding the potential legal and security risks involved, we’ll arm you with the knowledge to make informed decisions. We’ll also explore how these tools integrate with your existing business setup and discuss crucial aspects like customization and customer support. This isn’t just about finding a free tool; it’s about finding the

-right* free tool for your specific needs and understanding the trade-offs involved.

Understanding “Free Invoice” Software Options

Choosing the right invoicing software can be a game-changer for freelancers and small businesses. While paid options often boast advanced features, free invoice software provides a solid foundation for basic invoicing needs. This section explores several popular free options, comparing their features and limitations to help you make an informed decision.

Free Invoice Software Feature Comparison

The following table compares five popular free invoice software options. Remember that features and limitations can change, so always check the software’s website for the most up-to-date information.

| Software Name | Recurring Invoices | Expense Tracking | Payment Integrations | Client Management |

|---|---|---|---|---|

| Zoho Invoice (Free Plan) | Yes | Limited | Limited | Basic |

| Wave Accounting | Yes | Yes | Limited (requires Wave payment gateway) | Basic |

| Invoice Simple | No | No | No | Basic |

| FreshBooks (Free Trial, then Paid) | Yes (Paid Plan) | Yes (Paid Plan) | Yes (Paid Plan) | Yes (Paid Plan) |

| HoneyBook (Free Trial, then Paid) | Yes (Paid Plan) | Yes (Paid Plan) | Yes (Paid Plan) | Yes (Paid Plan) |

Limitations of Free Invoice Software

Free invoice software often comes with limitations compared to its paid counterparts. Understanding these limitations is crucial for determining if a free option suits your needs.

Here are some typical limitations:

- Feature Restrictions: Free plans usually offer a reduced feature set. For example, you might have limitations on the number of clients, invoices, or expenses you can track. This can be particularly restrictive for businesses experiencing rapid growth.

- Limited Payment Integrations: Many free options offer limited or no integration with popular payment gateways like PayPal or Stripe. This means you may have to rely on manual payment methods, which can be less efficient and increase the risk of late payments.

- Lack of Advanced Features: Free software typically lacks advanced features like automated reminders, recurring invoicing capabilities (sometimes), time tracking, project management tools, and robust reporting functionalities. These features are often essential for larger businesses or those requiring more detailed financial insights.

- Customer Support: Free software usually provides minimal or no customer support. If you encounter problems, you may have to rely on online forums or documentation, which can be frustrating and time-consuming.

- Branding Restrictions: Some free invoice software may include the provider’s branding on your invoices, which can affect your professional image.

Typical User Base for Free Invoice Software

Free invoice software is ideally suited for individuals and very small businesses with simple invoicing needs. This typically includes freelancers, solopreneurs, and small businesses with limited clients and low transaction volumes. For example, a freelance writer who sends out a few invoices per month might find a free option perfectly adequate. However, a rapidly growing e-commerce business with hundreds of transactions would likely outgrow the limitations of free software quickly.

Legal and Financial Implications of Using Free Invoices

Using free invoice software might seem like a great way to save money, especially when starting a business. However, it’s crucial to understand the potential legal and financial pitfalls before relying on these tools for all your invoicing needs. Ignoring these implications could lead to significant problems down the line, impacting everything from your tax returns to your business’s legal standing.Free invoice software, while convenient, often lacks the robust features and security of paid alternatives.

This can create several legal and financial risks.

Legal Risks Associated with Free Invoice Software

The legal risks associated with free invoice software primarily stem from inadequate features and potential security vulnerabilities. For example, many free options lack advanced features like audit trails or robust data encryption. This lack of robust record-keeping could become a problem if you ever face a legal dispute with a client or are audited by tax authorities. A lack of proper security could lead to data breaches exposing sensitive client information, resulting in legal liabilities and reputational damage.

Furthermore, some free services may have unclear terms of service regarding data ownership and liability, leaving you vulnerable if something goes wrong. Consider the case of a small bakery using a free invoice app; a data breach exposing customer credit card information could result in significant fines and legal action.

Importance of Accurate Record-Keeping with Free Invoice Generators

Accurate record-keeping is paramount, regardless of the invoicing software used. However, it becomes even more critical when using free invoice generators because these often lack the built-in safeguards and features found in paid software. Maintaining detailed, accurate records of all invoices, payments, and expenses is essential for several reasons. It simplifies tax preparation, provides crucial evidence in case of disputes, and helps you track your business’s financial health.

Imagine a freelance writer using a free invoice generator. If they fail to maintain accurate records of their income and expenses, they might struggle to file their taxes accurately, potentially leading to penalties or audits. Conversely, meticulous record-keeping offers a clear picture of the business’s performance, facilitating informed decision-making.

Impact of Free Invoice Software on Tax Preparation

Free invoice software can affect tax preparation in several ways. While it can simplify the process of generating invoices, it might lack features that aid in tax reporting. Many paid accounting software packages integrate directly with tax preparation programs, simplifying the process of transferring data. Free invoice generators may not offer this seamless integration, requiring manual data entry, increasing the chance of errors.

This manual process can be time-consuming and prone to mistakes, potentially leading to inaccuracies in your tax filings. For example, a small business owner using a free invoice generator might need to manually input all their income and expense data into their tax software, increasing the risk of errors and omissions. This could result in delays in filing, potential penalties, or even legal issues with tax authorities.

Furthermore, some free invoice software may not generate reports in the formats required by tax agencies, adding extra work to your tax preparation.

Security Considerations for Free Invoice Platforms

So, you’re thinking about using a free online invoice generator? Smart move for saving money, but let’s talk about something equally important: security. Free platforms, while convenient, often come with inherent security risks that need careful consideration. Understanding these vulnerabilities and implementing appropriate safeguards is crucial to protecting your business and client data.Free invoice platforms, by their nature, often lack the robust security features found in paid alternatives.

This means your sensitive data – client information, payment details, and your business financials – might be more vulnerable to breaches. The level of security can vary wildly depending on the specific platform, but generally, free services tend to invest less in sophisticated security infrastructure. This can leave them more susceptible to various attacks, from simple data breaches to more sophisticated phishing attempts.

Potential Security Vulnerabilities

Free invoice platforms can be vulnerable to several types of attacks. These range from simple data breaches due to inadequate encryption and weak passwords to more sophisticated attacks like SQL injection or cross-site scripting (XSS). Poorly designed platforms might expose data through unsecured APIs or lack sufficient protection against malware. Furthermore, the provider itself may have insufficient security practices, leading to vulnerabilities.

Consider the potential for a data breach exposing client contact details, payment information, and internal business documents. The consequences could be severe, including financial losses, legal repercussions, and reputational damage.

Best Practices for Protecting Sensitive Data, Free invoice

Protecting your data when using free invoice software requires a proactive approach. While the platform itself might have limitations, you can significantly reduce your risk by following these best practices:

- Strong Passwords and Two-Factor Authentication (2FA): Use unique, complex passwords for each online account, including your invoice platform. Enable 2FA whenever possible to add an extra layer of security.

- Regular Software Updates: Keep your software updated to patch known vulnerabilities. This includes both the invoice platform itself and your operating system and web browser.

- Secure Network Connection: Only access the invoice platform through secure, trusted networks. Avoid using public Wi-Fi or unsecured connections.

- Data Encryption: Look for platforms that offer data encryption, both in transit (when data is being sent) and at rest (when data is stored).

- Limited Data Storage: Avoid storing unnecessary sensitive data on the platform. Only keep the information absolutely required for invoicing.

- Regular Security Audits (If Possible): Some platforms might offer some level of security auditing. Explore this option if available.

- Careful Platform Selection: Research the platform’s security policies and reviews before using it. Look for evidence of security certifications or attestations.

Hypothetical Security Breach Scenario and Consequences

Imagine a scenario where a free invoice platform suffers a data breach due to a vulnerability in its code. A malicious actor gains access to the database containing client information and payment details. This could lead to identity theft for clients, fraudulent charges on their credit cards, and significant financial losses for both the clients and the business using the platform.

The business would face legal repercussions, potentially lawsuits from affected clients, and reputational damage, impacting its ability to attract new clients. The costs associated with remediation, legal fees, and potential compensation to clients could be substantial, far exceeding any savings achieved by using the free platform.

Integration with Other Business Tools: Free Invoice

Seamless integration with other business tools is a major factor to consider when choosing free invoice software. The ability to connect your invoicing system with your accounting software and CRM can significantly streamline your workflow and reduce the risk of errors. This integration allows for automatic data transfer, saving you valuable time and effort.The level of integration offered varies greatly depending on the specific free invoice platform.

Some platforms offer robust integrations with popular accounting and CRM systems, while others may only offer basic functionality or require manual data entry. This can significantly impact your overall efficiency and the time you spend managing your finances.

Integration Capabilities of Three Free Invoice Platforms

This section compares the integration options of three hypothetical free invoice platforms – “InvoiceEasy,” “BillBlast,” and “QuickBill” – to illustrate the range of capabilities available. Note that specific features and integrations are subject to change, and you should always check the latest information on the provider’s website.InvoiceEasy offers basic integration with Xero and QuickBooks Online, allowing for the import and export of invoice data.

However, real-time synchronization is not available; data must be manually triggered for transfer. Integration with CRM systems is limited, primarily focused on contact information import.BillBlast boasts more advanced integration capabilities. It offers real-time synchronization with Xero, QuickBooks Online, and Zoho CRM. This means that invoice data is automatically updated across all platforms, minimizing the chance of discrepancies.

So you need a free invoice? Lots of options are out there, but if you’re looking for something that can grow with your business, check out intuit quickbooks ; they have free invoice options and much more. Once you outgrow the free stuff, upgrading is super easy. Ultimately, finding the right free invoice generator depends on your needs, but QuickBooks is definitely worth a look.

It also supports Zapier, allowing for integration with a wider range of apps.QuickBill provides a middle ground. It integrates with QuickBooks Online and offers a limited API for custom integrations. While it doesn’t offer real-time sync with all platforms like BillBlast, it’s more flexible than InvoiceEasy and allows for some level of automation through custom scripting.

Benefits and Drawbacks of Integrating Free Invoice Software with Other Business Tools

Integrating your free invoice software with other business tools presents several significant benefits and drawbacks.Benefits include: reduced data entry errors (through automation), improved accuracy of financial records, enhanced workflow efficiency (less time spent manually transferring data), better client relationship management (through CRM integration), and a more holistic view of your business finances.Drawbacks include: potential security risks (if not properly managed), dependence on third-party software (and their potential for downtime or changes), complexity of setup and configuration (particularly for more advanced integrations), and potential limitations in functionality (if the integration isn’t fully seamless).

For example, a poorly integrated system might lead to duplicate data entries or inconsistencies between your invoicing and accounting systems, negating the time-saving benefits. Choosing a platform with a well-documented and reliable integration process is key to avoiding these issues.

User Experience and Interface Design

Choosing the right free invoice software hinges significantly on its user experience. A clunky, unintuitive interface can quickly negate the cost savings, wasting valuable time and potentially leading to errors. A well-designed interface, on the other hand, streamlines the invoicing process, making it efficient and less prone to mistakes.The user interface (UI) of free invoice software varies greatly.

Some prioritize simplicity, while others offer more advanced features, often at the cost of increased complexity. Understanding these differences is key to selecting a platform that best suits your needs and technical skills.

Invoice Ninja’s User Interface

Invoice Ninja, a popular free invoicing platform, presents a clean and relatively straightforward interface. The dashboard typically displays a summary of outstanding invoices, upcoming payments, and overall financial health. Navigation is generally intuitive, with clearly labeled menus and buttons guiding users through the creation, sending, and management of invoices. The overall aesthetic is minimalist, prioritizing functionality over flashy design elements.

Creating an invoice usually involves filling out a simple form with fields for client details, items, payment terms, and notes. While not overly complex, it does provide sufficient options for customization.

Usability and Intuitiveness Comparison

The following table compares the usability and intuitiveness of three popular free invoice platforms: Invoice Ninja, Zoho Invoice (free plan), and FreshBooks (free trial). The evaluation is subjective and based on general user feedback and experience.

| Feature | Invoice Ninja | Zoho Invoice (Free Plan) | FreshBooks (Free Trial) |

|---|---|---|---|

| Ease of Navigation | Good – Clear menus and intuitive layout. | Fair – Can be slightly cluttered, especially for new users. | Excellent – Very streamlined and user-friendly. |

| Invoice Creation Process | Good – Straightforward form-based process. | Fair – Requires more steps than Invoice Ninja. | Excellent – Quick and efficient, with helpful prompts. |

| Customization Options | Good – Offers sufficient customization for basic needs. | Good – Provides decent customization options. | Excellent – Highly customizable, allowing for branding and advanced features. |

| Overall Intuitiveness | Good – Easy to learn and use, even for beginners. | Fair – Requires some learning curve for optimal use. | Excellent – Extremely intuitive and user-friendly. |

Examples of Good and Bad User Interface Design

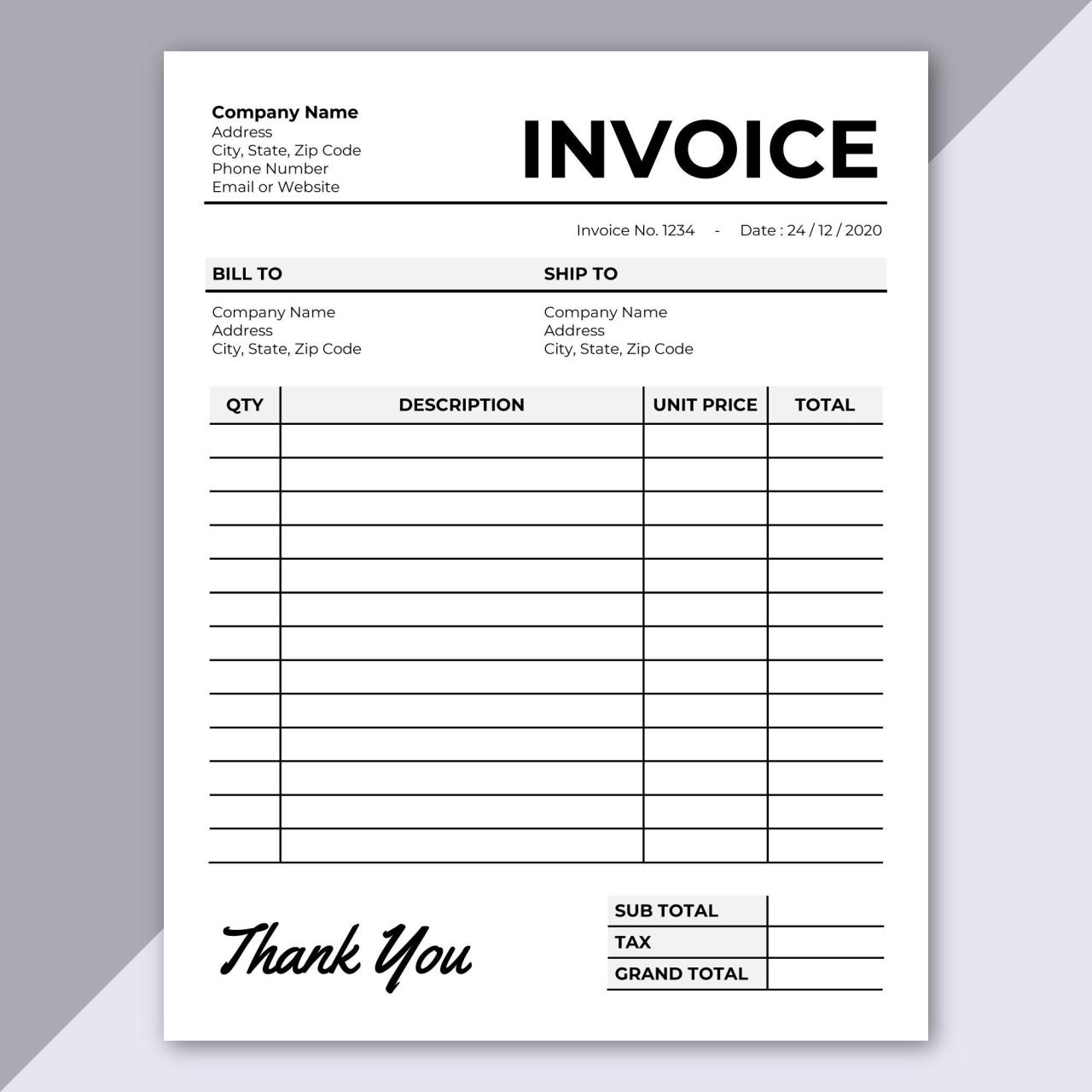

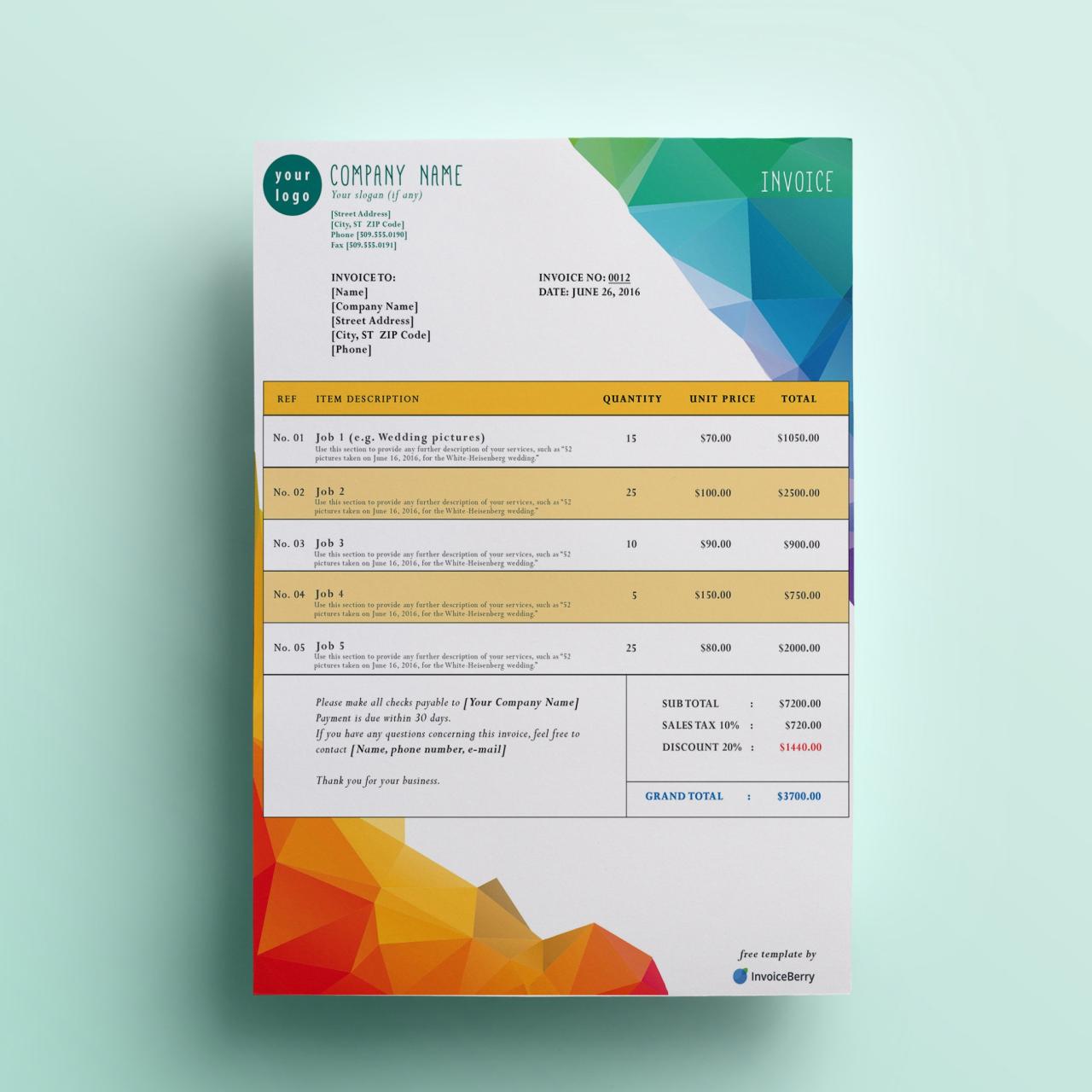

A good example of UI design in free invoice software is a clear and concise invoice template with logically grouped fields. For example, client information should be clearly separated from item details and payment terms. Easy-to-understand icons and visual cues can also enhance usability. A clean, uncluttered layout prevents cognitive overload, allowing users to focus on the task at hand.

Conversely, a bad example would be a cluttered interface with inconsistent formatting, confusing navigation, and poorly labeled buttons. Overly complex features crammed into a small space, leading to a frustrating user experience, would also qualify as poor design. For instance, a system requiring multiple clicks to perform a simple task or one with inconsistent use of terminology would significantly detract from usability.

Customization and Branding Options

Choosing the right free invoice software often hinges on its ability to reflect your brand’s identity. A generic invoice can feel impersonal and unprofessional, potentially undermining your business’s credibility. Customizable features allow you to create invoices that are not only functional but also visually appealing and consistent with your brand’s overall aesthetic. This helps build trust with clients and reinforces your professional image.Branding options are crucial for creating a consistent brand identity across all business communications.

A well-branded invoice reinforces your company’s professionalism and helps establish recognition. Conversely, a poorly designed or generic invoice can detract from your brand and diminish your professional standing. The level of customization available varies significantly between different free invoice generators.

Branding Options in Zoho Invoice

Zoho Invoice, a popular free option (with limitations on the free plan), offers a decent level of customization. Users can upload their company logo, choose from a variety of pre-designed templates, and customize the color scheme to match their brand. They can also add their company address, phone number, and other contact details directly to the invoice. While it doesn’t offer the same level of granular control as paid software, the free version allows for sufficient branding to create a professional-looking invoice.

For instance, a small bakery could upload its logo and use a pastel color scheme to create a visually appealing invoice that reflects their brand identity.

Comparison of Customization Features: Zoho Invoice vs. Invoice Ninja

Zoho Invoice and Invoice Ninja represent different approaches to free invoice generation. Zoho Invoice provides a more streamlined, user-friendly experience with pre-designed templates and a limited color palette. Invoice Ninja, on the other hand, offers more flexibility in terms of template customization but might require more technical expertise to fully utilize its features. Zoho Invoice’s strength lies in its ease of use, making it ideal for users who prioritize simplicity and speed.

Invoice Ninja, however, appeals to users who need more control over the visual aspects of their invoices and are comfortable with a slightly steeper learning curve. A freelancer might find Invoice Ninja’s flexibility beneficial, allowing them to create a unique invoice that sets them apart. A small retail business, however, might prefer Zoho Invoice’s ease of use.

Impact of Customization on Professional Image

Customization significantly impacts a business’s professional image. A well-branded invoice, featuring a professional logo, consistent color scheme, and clear contact information, projects an image of professionalism and competence. This instills confidence in clients and helps establish credibility. Conversely, a poorly designed or generic invoice can convey a lack of professionalism and attention to detail, potentially damaging a business’s reputation.

Using a consistent brand identity across all invoices, from logo placement to color schemes, creates a cohesive and professional image that builds brand recognition and trust with clients. For example, a law firm using a sophisticated template with a professional logo conveys a level of competence and trust that a generic invoice simply cannot. This reinforces the firm’s professional image and helps build client confidence.

Support and Customer Service

Choosing free invoice software often involves a trade-off: you get the functionality at no cost, but the level of support might not match paid options. Understanding the support landscape is crucial for making an informed decision, as timely and effective assistance can be the difference between smooth operations and frustrating downtime. This section explores the typical support options available and compares the responsiveness of three popular platforms.

Most free invoice software providers offer some form of customer support, although the extent and quality can vary widely. Common options include FAQs (Frequently Asked Questions) sections on their websites, email support, and sometimes a community forum where users can help each other. Live chat support is less common with free plans, often reserved for paying customers. The availability of phone support is even rarer for free services.

Typical Support Options for Free Invoice Software

Free invoice software providers typically offer a tiered support system. The most basic level usually involves a comprehensive FAQ section, covering common issues and troubleshooting steps. This self-service option allows users to quickly find answers to simple questions without needing to contact support directly. Many providers also offer email support, where users can submit detailed inquiries and receive responses within a reasonable timeframe (though response times can vary).

Some platforms also feature community forums, enabling users to interact with each other and share solutions. This collaborative approach can be particularly helpful for resolving less common problems. However, the reliability and speed of responses depend heavily on the platform’s active user base and the provider’s moderation of the forum.

Comparison of Customer Service Responsiveness for Three Free Invoice Platforms

To illustrate the variations in customer service, let’s consider three hypothetical free invoice platforms: InvoiceEasy, FreeBillPro, and SimpleInvoice. InvoiceEasy boasts a robust FAQ and a very active community forum, where users often help each other within hours. Email support, while available, can take up to 48 hours for a response. FreeBillPro provides only email support, with response times averaging 24-72 hours.

Their FAQ section is minimal. SimpleInvoice, conversely, offers live chat support during business hours, in addition to email support (with a response time similar to InvoiceEasy). This highlights the significant differences in the level and speed of support even within the realm of free software. The experience of users can vary greatly depending on the platform chosen.

Importance of Reliable Customer Support for Free Invoice Software Users

Reliable customer support is particularly critical for users of free invoice software because they often lack the dedicated account management or priority support offered to paying customers. When encountering technical glitches, billing errors, or other issues, quick and effective assistance is essential to minimize disruptions to business operations. A platform with responsive and helpful support can prevent lost productivity and potential financial losses.

The lack of such support, on the other hand, can lead to frustration, lost time spent troubleshooting, and ultimately, a negative impact on the user’s business. Therefore, evaluating the quality and availability of support is as important as considering the software’s features when selecting a free invoice platform.

Scalability and Future Growth

Free invoice software is a great starting point for many small businesses, offering a convenient and cost-effective way to manage billing. However, as your business expands, the limitations of these free tools become increasingly apparent. Understanding these limitations and planning for a smooth transition to a more robust solution is crucial for sustained growth.The features of free invoice software are often tailored to the needs of small businesses with limited transaction volumes and simple accounting requirements.

As a business scales, these limitations can manifest in various ways, impacting efficiency and potentially even hindering financial accuracy. For example, a significant increase in invoice volume might overwhelm a free platform’s processing capabilities, leading to delays and frustration. More complex accounting needs, such as managing multiple currencies or integrating with sophisticated inventory management systems, are often beyond the scope of free options.

Limitations of Free Invoice Software for Growing Businesses

Rapid growth often brings complexities that free invoice software struggles to handle. Imagine a small online retailer experiencing a sudden surge in popularity. Their free invoicing platform, designed for a handful of invoices per month, might suddenly be swamped with hundreds or thousands. This could lead to slow processing times, potential data loss due to server overload, and difficulties in managing multiple clients and projects.

Furthermore, limited reporting capabilities might make it challenging to analyze sales trends and make informed business decisions. The lack of robust security features in free platforms also becomes a bigger concern as sensitive financial data increases. A well-known example of this type of scaling issue is a startup that initially relied on a free CRM and invoicing platform, but as they secured a large contract, the platform struggled to handle the increased workload, leading to significant delays and operational inefficiencies.

Changes in Free Invoice Software Features with Business Scaling

As your business grows, the features you need from your invoicing software will evolve. Simple invoice generation will likely be replaced by a need for advanced features like automated recurring billing, expense tracking, payment processing integration, and sophisticated reporting tools. Free options typically lack these capabilities, forcing businesses to either rely on manual workarounds (which quickly become unsustainable) or to switch to a paid solution.

For instance, a small consultancy might initially only need basic invoicing, but as it expands and hires employees, the need for features like time tracking and project management integration becomes essential—features rarely found in free software.

Transitioning from Free to Paid Invoice Software

Moving from a free to a paid invoicing platform requires careful planning and execution. The first step involves a thorough assessment of your current needs and future projections. This will help identify the features you require in a paid solution. Next, research different paid options, comparing their features, pricing, and integration capabilities. Data migration is a critical aspect.

Most paid platforms offer data import tools, but it’s essential to understand the process and ensure a smooth transition to avoid data loss or inconsistencies. Finally, plan for employee training on the new platform to ensure a seamless workflow and minimize disruption during the transition. A well-planned transition minimizes downtime and ensures the continued smooth operation of the business during this crucial shift.

For example, many businesses opt for a phased approach, migrating data incrementally to minimize the risk of disruption.

Common User Errors and Troubleshooting

Using free invoice software can be a huge time-saver for small businesses, but even the simplest tools can trip users up. This section highlights common mistakes and provides solutions to get you back on track with your invoicing. We’ll cover typical errors, offer troubleshooting steps, and answer frequently asked questions to keep your invoicing smooth and efficient.

Many problems stem from simple oversights or misunderstandings of the software’s features. For example, incorrect client information, accidental deletion of invoices, or issues with payment processing are common headaches. Understanding these pitfalls and knowing how to fix them can save you significant time and frustration.

Common User Errors

Here are three common errors users make when using free invoice software, along with brief explanations:

- Incorrect Client Information: Entering inaccurate client names, addresses, or contact details leads to delays in payment and can damage professional relationships. Double-checking information before sending an invoice is crucial.

- Accidental Deletion of Invoices: Free invoice software often lacks robust undo features. Carefully review invoices before deleting them, and consider backing up your data regularly.

- Payment Processing Issues: Integration with payment gateways can be tricky. Ensure your account is properly configured and that you’ve correctly entered all necessary details, such as API keys or bank account information. Problems can also arise from outdated plugins or browser issues.

Troubleshooting a Common Problem: Invoice Not Sending

One frequent issue is the failure of an invoice to send. This can stem from various problems. Here’s a step-by-step guide to troubleshooting this:

- Check your internet connection: A weak or unstable internet connection can prevent the invoice from sending. Try refreshing the page or connecting to a different network.

- Verify email address: Double-check that the client’s email address is correctly entered and formatted. Typos are a common culprit. Consider using a separate email client to test sending to the same address.

- Review spam filters: The invoice might have been flagged as spam. Ask the client to check their spam or junk folder. If it’s consistently ending up there, you may need to adjust your email settings or use a different sending method.

- Check your software settings: Some free invoice software requires specific email settings to be configured correctly. Consult the software’s help documentation or support resources to ensure your settings are accurate. For example, you might need to adjust SMTP settings or verify outgoing email permissions.

- Contact support: If the problem persists after trying the above steps, contact the software’s support team for assistance. Provide them with details of the issue and any error messages you’ve encountered.

Frequently Asked Questions

Here are answers to some common questions users have about free invoice software:

- Is free invoice software secure? Security varies greatly depending on the provider. Look for software with encryption and secure payment processing features. Regularly update the software to patch security vulnerabilities.

- Can I customize free invoice templates? Most free invoice software offers some level of customization, allowing you to add your logo and business information. However, the extent of customization may be limited compared to paid options.

- What happens if I exceed the free plan’s limitations? Free plans usually have limits on the number of invoices, clients, or features. You may need to upgrade to a paid plan or find alternative solutions if you surpass those limits. Some free plans may offer limited functionality, requiring an upgrade to unlock all features.

- How do I integrate free invoice software with other business tools? Integration capabilities vary. Some software integrates with accounting software or payment gateways, while others may not. Check the software’s features before choosing one.

Alternatives to Free Invoice Software

Choosing the right invoicing software is crucial for any business, regardless of size. While free options offer an accessible entry point, they often come with limitations. Exploring alternatives provides a clearer picture of the best fit for your specific needs and budget. Let’s look at some paid options and consider when free software simply isn’t enough.

Comparison of Free Invoice Software Alternatives

The following table compares three alternatives to free invoice software, highlighting their advantages and disadvantages. Remember that pricing and features can change, so always check the provider’s website for the most up-to-date information.

| Software | Advantages | Disadvantages |

|---|---|---|

| Zoho Invoice | Robust feature set including expense tracking, recurring invoices, and payment processing; integrates with other Zoho apps; offers a free plan with limitations. | Free plan has significant limitations; paid plans can be expensive for small businesses; learning curve can be steeper than some other options. |

| FreshBooks | User-friendly interface; excellent mobile app; strong reporting features; integrates with various accounting and payment platforms. | Free plan is extremely limited; pricing can be higher than some competitors, particularly for larger businesses. |

| Xero | Powerful accounting software with integrated invoicing; extensive reporting and financial analysis tools; integrates with a wide range of third-party apps. | Steeper learning curve than simpler options; more expensive than many alternatives; may be overkill for very small businesses. |

Scenarios Where Free Invoice Software is Unsuitable

Free invoice software often lacks essential features for growing businesses. For example, a rapidly expanding company needing advanced features like automated payment reminders, multiple user access, detailed financial reporting, or seamless integration with accounting software would quickly outgrow the limitations of a free platform. Similarly, businesses handling a high volume of invoices might find the performance and scalability of free software inadequate, leading to inefficiencies and potential errors.

Businesses prioritizing robust security features and data protection might also prefer a paid solution offering enhanced security measures.

Cost-Benefit Analysis of Free vs. Paid Invoice Software

The decision between free and paid invoice software hinges on a cost-benefit analysis. Free software offers zero upfront costs, making it attractive to startups or businesses with very low invoice volumes. However, this often comes at the cost of limited features, potentially leading to inefficiencies and lost time. Paid software, while incurring a monthly or annual fee, usually provides advanced features, better security, and enhanced scalability.

For example, a small business processing 10 invoices a month might find a free plan sufficient. However, a business processing 500 invoices monthly, needing automated payment processing and detailed reporting, would likely find the cost of a paid solution easily justified by the time saved and increased efficiency. The potential for lost revenue due to inefficiencies with free software should also be factored into this analysis.

The cost of lost time and potential errors from a less robust system can quickly outweigh the cost of a paid subscription.

Conclusion

So, is free invoice software the right choice for you? The answer, like most things in business, is “it depends.” While free options offer incredible convenience and cost savings, understanding their limitations is key. Weigh the pros and cons carefully, considering your business size, financial situation, and long-term goals. By carefully considering the factors discussed here—security, scalability, and user experience—you can confidently choose the solution that best fits your needs and helps you stay organized and profitable.

Questions and Answers

Can I use free invoice software for large businesses?

Probably not long-term. Free options often lack the features and scalability needed for rapid growth. You might outgrow them quickly.

What happens if the free invoice software company goes under?

Your data could be lost or inaccessible. Choose reputable providers and back up your invoices regularly.

Are free invoice templates legally binding?

Yes, generally, as long as they contain all the necessary information (client details, services rendered, payment terms, etc.). However, legal requirements vary by location.

Is my data safe with free invoice software?

It depends on the provider’s security measures. Look for platforms with strong encryption and security protocols. Read their privacy policies carefully.

What if I need more advanced features later?

Many free services offer paid upgrades or you can switch to a paid platform. Plan for potential growth and feature needs.